Container shipping giants MSC Mediterranean Shipping Company (MSC) and Maersk A/S, an entity under A.P. Moller – Maersk, have agreed to terminate the 2M alliance, effective in January 2025.

2M is a container shipping line vessel sharing agreement (VSA) signed by the duo in 2015 with the aim of ensuring competitive and cost-efficient operations on the Asia-Europe, Transatlantic and Transpacific trades by sharing vessel space and network capacity.

The 2M agreement has a minimum term of 10 years with a 2-year notice period of termination.

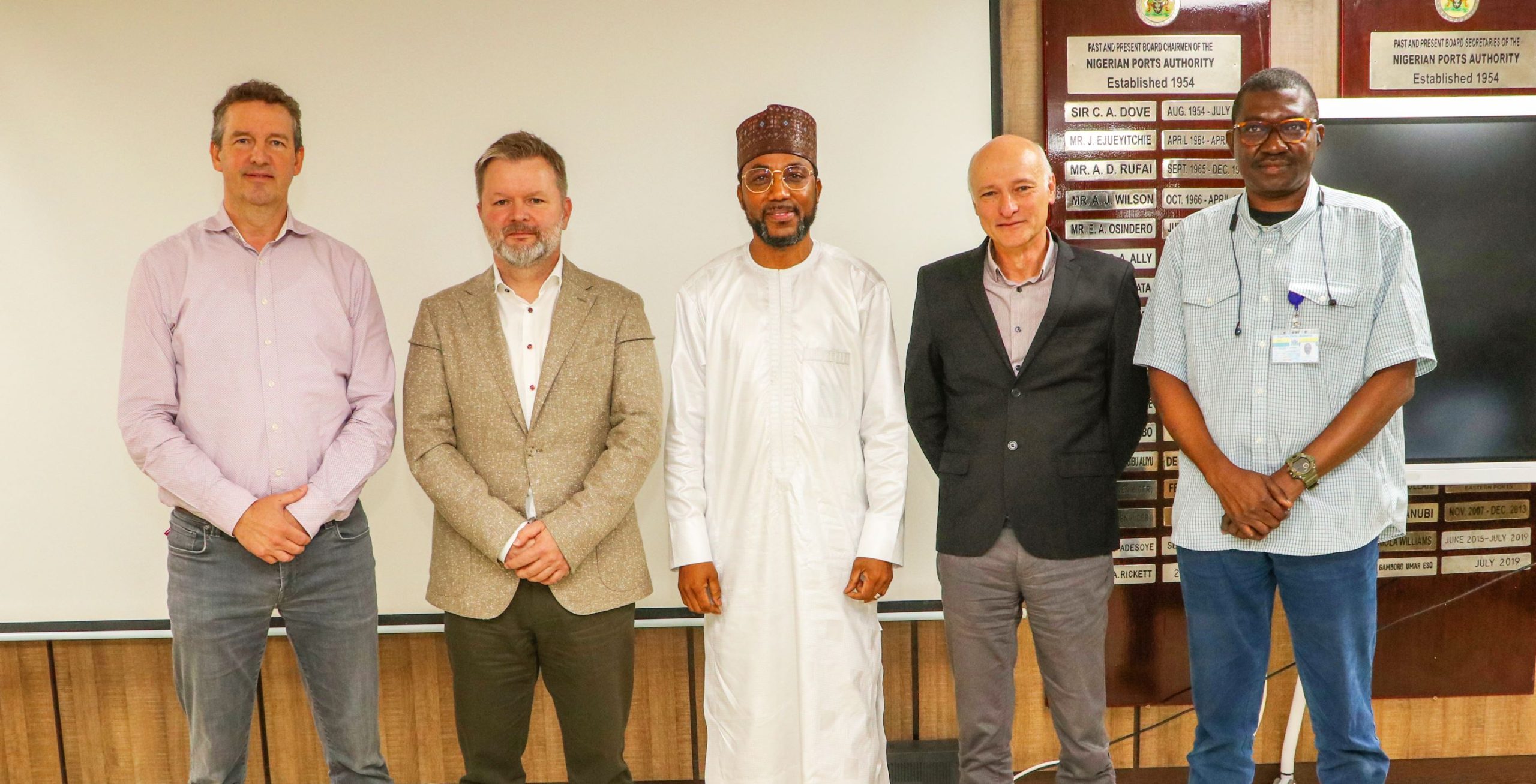

“MSC and Maersk recognize that much has changed since the two companies signed the 10-year agreement in 2015. Discontinuing the 2M alliance paves the way for both companies to continue to pursue their individual strategies,” Vincent Clerc, CEO of A. P. Moller – Maersk, and Soren Toft, CEO of MSC said in a joint statement.

“We have very much appreciated the partnership and look forward to a continued strong collaboration throughout the remainder of the agreement period. We remain fully committed to delivering on the 2M alliance’s services to customers of MSC and Maersk.”

The duo said that the announcement has no immediate impact on the services provided on the 2M trades.

“The 2M alliance played a key role in supporting the container shipping industry over the past eight years,” Toft said.

“At MSC today, we continue to strengthen and modernize our fleet, providing us with the scale we need for the most comprehensive ocean and short-sea shipping network in the market.”

The company added that 2M was introduced in 2015 at a time when the ocean carrier industry needed an injection of stability.

“MSC is grateful for the operational cooperation with Maersk over the past eight years and expects the concept of ocean liner vessel-sharing to remain relevant and beneficial,” the company further said.

The 2M alliance operates over 200 ships and serves more than 200 ports in around 120 countries. According to the alliance, the 2M partnership serves around 40% of the world’s container trade.

The termination comes on the back of MSC’s massive fleet expansion over the past two years which has seen 411,000 TEU slots (+10.7%) added in 2021, and another 321,500 TEU (+7.5%) last year, according to the data from Alphaliner.

The company has also embarked on a colossal newbuilding program comprising 124 ships (+10). The capacity build-up has been described as a strategic move positioning MSC to leave 2M Alliance and operate as a stand-alone carrier in the major deep-sea trades.

Namely, by the end of 2024, MSC is expected to have a total capacity approximately equal to that of MSC and Maersk combined when the two carriers formed the alliance.

Container shipping expert Lars Jensen believes the move is just the start of re-shaping of the alliance/VSA constellations on the major east-west trades.

“This will change the competitive dynamics on the major east-west trades for all major carriers, and clearly all carriers will take a close look at which threats and opportunities this will bring forth,” he said.

“In essence, this should be seen as the first domino of many to fall over the next 1-2 years.”

“Even if 2M formally runs until January 2025 it should be expected that Maersk’s and MSC’s networks on the alliance trades will begin to deviate even more in 2023 through different VSA and slot charter agreements.”

The announcement is being made in the wake of a major downturn for the container shipping sector as liner companies ready for strong headwinds in 2023. Specifically, inflation and recession impacts are pushing down freight rates. The situation is further exacerbated by tonnage overcapacity and ordering frenzy by liner majors over the past couple of years.

Credit: World Maritime News