|

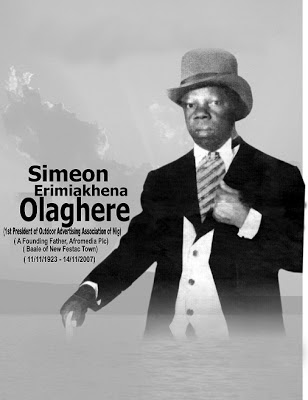

| File Photo |

sustainable financing of Nigeria’s membership subscription in the African

Union, AU.

The Federal Government also approved an extension of a Central Bank of Nigeria

intervention that will be used to support the power sector specifically the

generation arm of the sector.

disclosed this while briefing State House Correspondents at the end of the

weekly FEC meeting presided over by the Vice president, Yemi Osinbajo at the

Council Chamber, Presidential Villa, Abuja.

percent as the new import levy on Cost, Insurance and Freight, CIF that will be

charged on imports coming into Nigeria from AU countries. She explained that

there are some exceptions on goods originating outside the territory of member

countries.

council meeting approved a new import levy for sustainable financing of

Nigeria’s membership subscription in the African Union.

import levy on Cost, Insurance, and Freight (CIF) that will be charged on

imports coming into Nigeria but with some exceptions.

from outside the territory of member countries that are coming into the country

for consumption.

for aid and also it includes goods that are originating from non-member

countries but are imported through specific financing agreements that ask for

such kinds of exemptions. It also exempts goods that have been ordered and are

under importation process before the scheme was announced into effect.”

this new levy is to enable the African Union member countries pay on a

sustainable basis their subscriptions to African Union.

knowing that what will accrue from this new levy will be more than what is

required as subscriptions to the African Union, that the balance that will be

left will be ring first and put in a special account in the Central Bank of

Nigeria and will be used to finance her subscriptions to multilateral organizations

as the World Bank, African Development Bank, Islamic Development Bank and

institutions like that.

in the revenue pool, it will be used to finance the budget.”

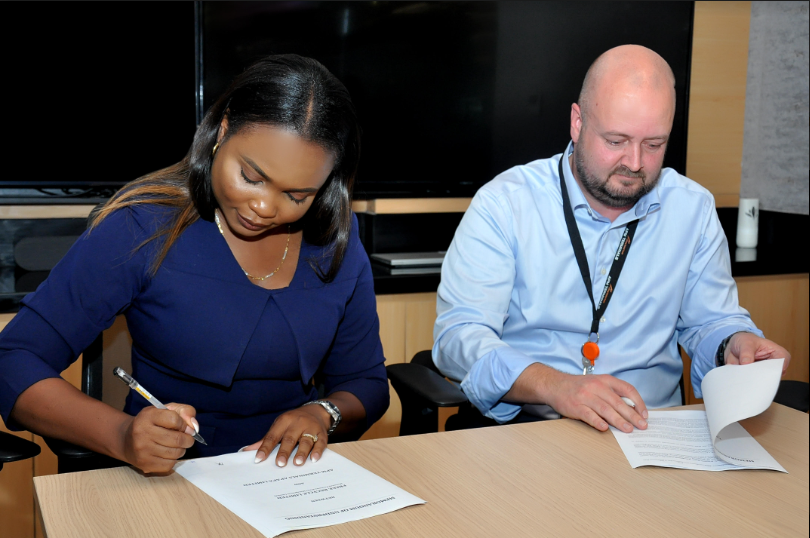

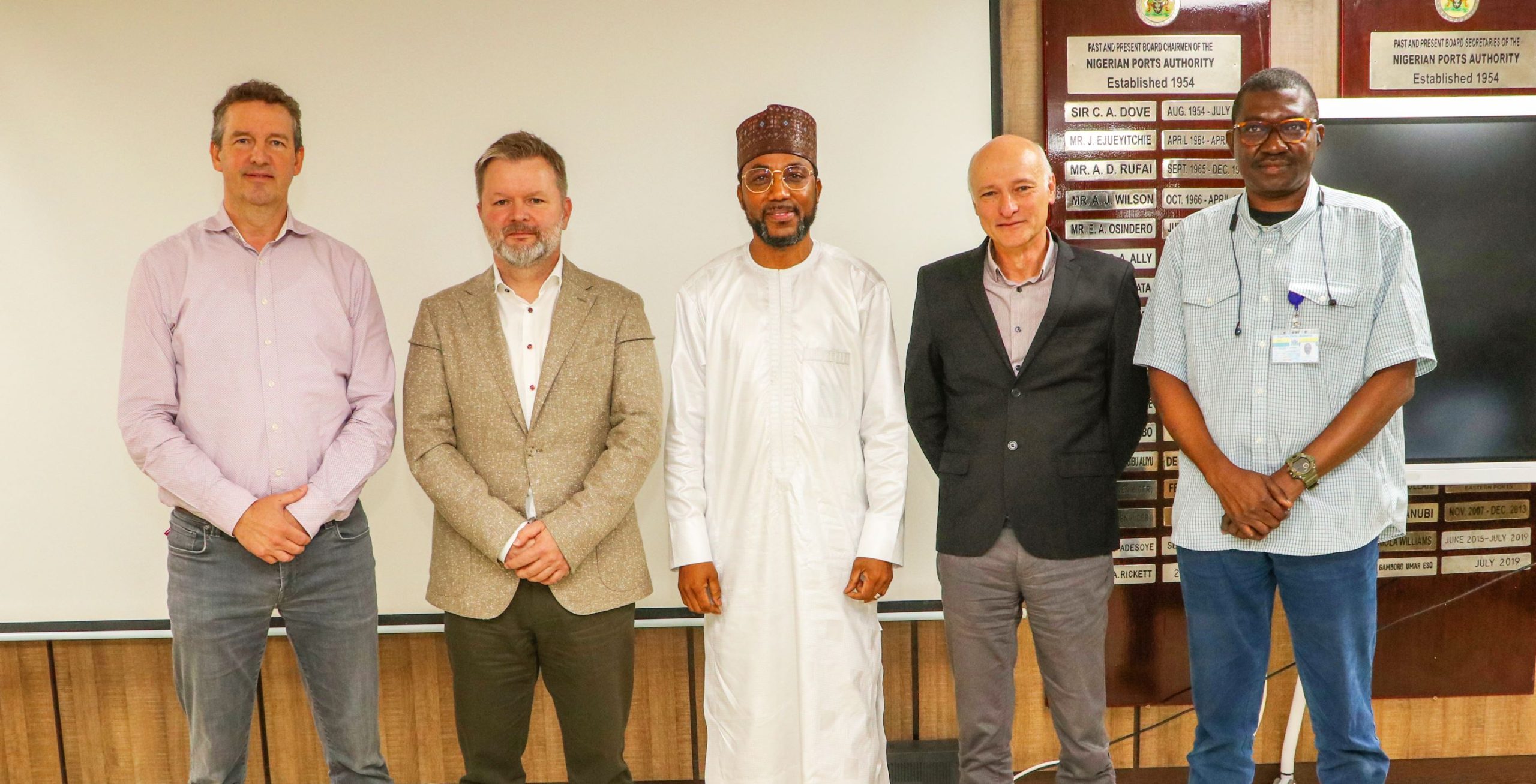

she said, “The second approval was the setting up of the steering committee to

be chaired by the Vice President for the design and implementation of a

national single window.

that would be able to integrate all the government agencies that are operators

that are implementers in the port business or trading in the port system.

efficiency of port operations and we project that it will significantly increase

government revenues.”

She said that the Council also approved an extension of a Central Bank of

Nigeria intervention that will be used to support the power sector specifically

the generation arm of the sector.

signed into as a country, where we have several guarantees to the Generation

Companies (GenCos) to bridge any gap that they have after the Nigerian Bulk

Electricity Trading Plc (NBET) has settled them,” she said.

Recall that the CBN had earlier stepped into the liquidity and funding

challenges facing the electricity sector and disbursed a total of N120.2

billion to different electricity distribution companies (DISCOs), power

generating companies (GENCOs), service providers and gas companies.

is under the N 213 billion Nigerian Electricity Market Stabilization Facility

(NEMSF), was made in 2016.

Government also signed power purchase agreements by the Nigerian Bulk

Electricity Trader (NBET) to signal activation of industry contracts for power

generation under a contract based market. Explaining on the AU levy, she said

that the African Union took the decision to enforce the levy by member

countries.

Nigeria is to domesticate and implement this decision that was taken in Kigali

on the 27th Assembly of the Heads of State and Government of African Union

meetings.

will open a central bank account for that particular purpose so all the funds collected

by the Nigerian customs will be pooled into that account.

when the AU raises a subscription invoice, we will settle from that account and

whatever is left, we can use it also to settle our subscriptions to other

multilateral institutions and if there is anything left, the balance is used to

finance the budget.

we got approval for today is to pay the gencos for any financing shortfall that

they have after the bulk trader NBET settles them. So it is a cost on

government, it is loan, government will be paying it back to the central bank.

“The

essence is to meet the contract obligations that government signed with the

gencos on the assurance we gave them on off taking any power that they generate

after payment is made from the NBET.”

The Vanguard.