Digital application process:

Applicants can apply from anywhere in the world using a smartphone or computer via the CVFF application portal.

Application through approved banks (PLIs):

Applications are submitted through pre-qualified Primary Lending Institutions (PLIs), including First Bank, Zenith Bank, UBA, Union Bank, Fidelity Bank, Bank of Industry, and others selected through a transparent process.

Eligibility requirements:

Applicants must present a bankable feasibility study, contribute a minimum of 15% equity, demonstrate managerial and operational competence, provide acceptable collateral, and meet other CVFF requirements.

Bank-led credit assessment:

The chosen PLI conducts its own credit review using internal processes and timelines, committing at least 15% of the facility.

Funding structure:

CVFF can participate up to 70% of the financing, capped at $25 million or its equivalent, while credit risk rests primarily with the bank.

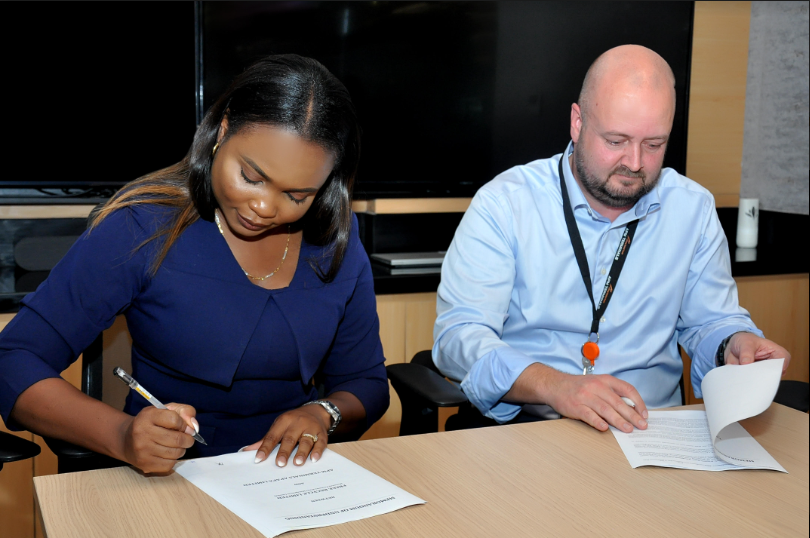

Issuance of term sheet:

Once the bank is satisfied, a formal term sheet is issued, defining the structure of the transaction.

NMASA due diligence:

The CVFF Secretariat and appointed advisers at NMASA conduct due diligence and eligibility checks.

Certificate of eligibility:

NMASA issues a certificate of eligibility to qualified applicants, ensuring transparency and compliance.

Executive and ministerial approval:

NMASA obtains internal approvals and seeks final consent from the Minister of Marine and Blue Economy.

Offer letter issuance:

After approval, a substantive offer letter is issued to the applicant, outlining terms and conditions.

*Fund disbursement:

Upon meeting all legal, financial, and operational conditions, NMASA disburses funds to the PLI within 72 hours of a valid request.

Strict use of funds:

Funds are deployed strictly for the approved transaction purpose under the supervision of the PLI and NMASA.

Repayment and monitoring:

Repayment begins as scheduled, with interest income remitted back to the CVFF. Continuous monitoring and reporting are carried out.

Risk management and recovery:

In case of default, recovery is handled by the PLI with institutional support from NMASA.

Completion of transaction:

At maturity, successful applicants are formally discharged, the transaction is closed, and indigenous maritime capacity is strengthened.