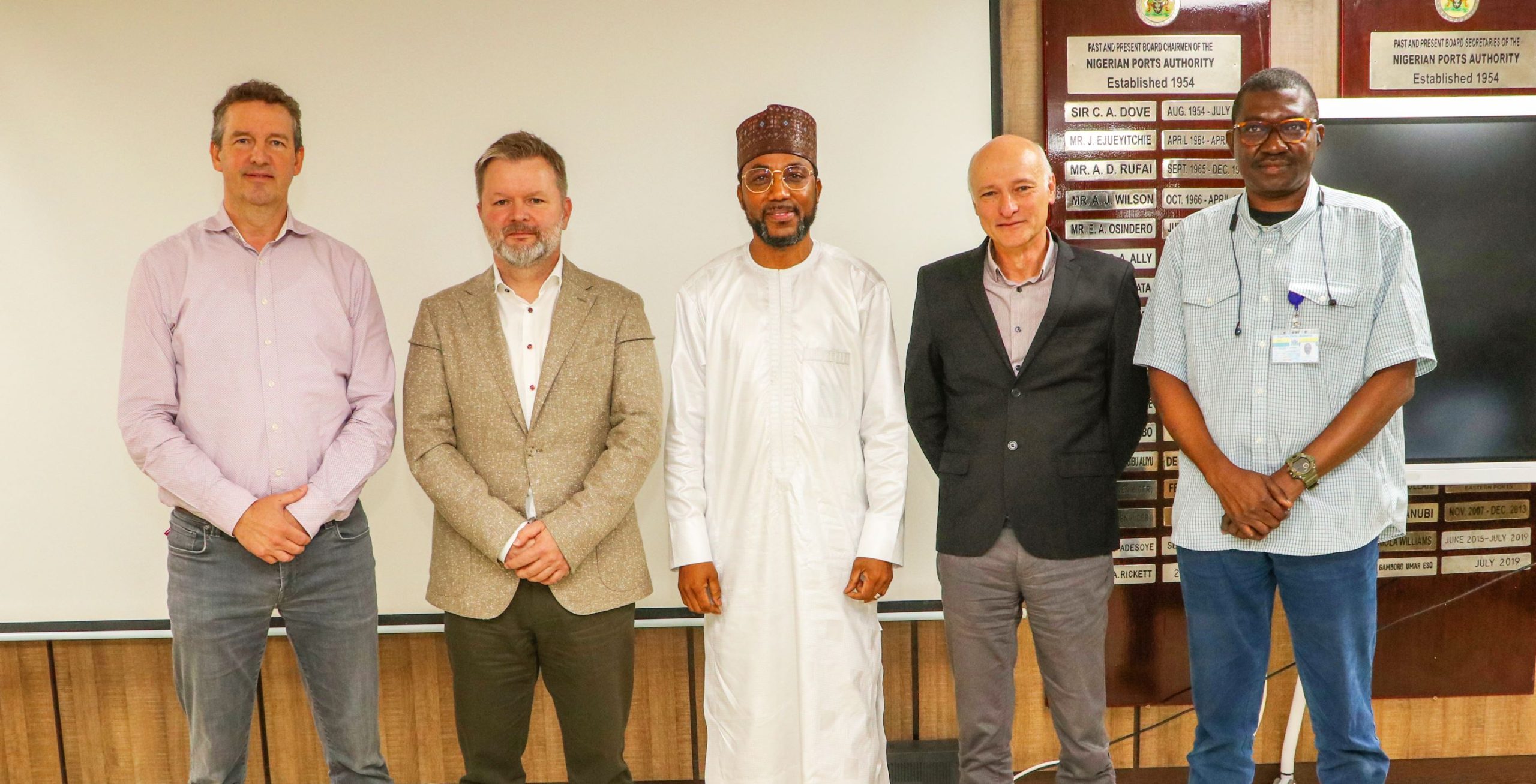

The Nigerian ship owners and other stakeholders in the shipping sector have

suggested groupings and joint ventures as alternatives to ship acquisition financing.

The ship

owners made the suggestion during the 2nd edition of the Nigerian Ship

Finance Conference and Exhibition (NISFCOE) which closed on Wednesday in Lagos.

owners made the suggestion during the 2nd edition of the Nigerian Ship

Finance Conference and Exhibition (NISFCOE) which closed on Wednesday in Lagos.

The News

Agency of Nigeria (NAN) reports that the theme of the event was:

“Advancing Ship & Maritime Infrastructure Financing in Nigeria: Innovative

Concepts & Sustainable Approaches.”

Agency of Nigeria (NAN) reports that the theme of the event was:

“Advancing Ship & Maritime Infrastructure Financing in Nigeria: Innovative

Concepts & Sustainable Approaches.”

NISFCOE is

part of efforts to correct the declining state of shipping in the country.

part of efforts to correct the declining state of shipping in the country.

In his

presentation at the conference, Prof. Fabian Ajogwu, said that shipping had

evolved globally but noted that Nigeria should continue to look at the issues

of shipping from the traditional standpoint.

presentation at the conference, Prof. Fabian Ajogwu, said that shipping had

evolved globally but noted that Nigeria should continue to look at the issues

of shipping from the traditional standpoint.

Ajogwu said

that ship ownership had gone beyond one man owning and managing vessels to an

era where a group of individuals and organisations would own vessels and

outsource the management to experts in the business.

that ship ownership had gone beyond one man owning and managing vessels to an

era where a group of individuals and organisations would own vessels and

outsource the management to experts in the business.

According to

him, Nigerian ship owners need to utilise the power of pulling as it would be

better if they own five per cent of a vessel working for any of the

International Oil Companies (IOCs).

him, Nigerian ship owners need to utilise the power of pulling as it would be

better if they own five per cent of a vessel working for any of the

International Oil Companies (IOCs).

“People need

to raise fund but a ship isn’t an hotel that you build and expect patronage.

Rather, you have to secure the source of repayment upfront by having contracts

within the oil and gas sector.

to raise fund but a ship isn’t an hotel that you build and expect patronage.

Rather, you have to secure the source of repayment upfront by having contracts

within the oil and gas sector.

“It is this

stream of cash flow that would enable you repay the debt,’’ he said.

stream of cash flow that would enable you repay the debt,’’ he said.

Ajogwu also warned

the Nigerian Maritime Administration and Safety Agency (NIMASA) not to disburse

the Cabotage Vessel Finance Fund (CVFF) to individual ship owners, saying the

agency had no capacity to ensure repayment.

the Nigerian Maritime Administration and Safety Agency (NIMASA) not to disburse

the Cabotage Vessel Finance Fund (CVFF) to individual ship owners, saying the

agency had no capacity to ensure repayment.

He said that

NIMASA should do onward lending to the banks so that the banks would in turn

lend to the ship owners.

NIMASA should do onward lending to the banks so that the banks would in turn

lend to the ship owners.

“The banks

have the wherewithal to do the feasibility study of the projects as well as the

business plan.

have the wherewithal to do the feasibility study of the projects as well as the

business plan.

“The banks

are also in better positions to go after the ship owners to ensure that they

repay the loans,’’ Ajogwu said.

are also in better positions to go after the ship owners to ensure that they

repay the loans,’’ Ajogwu said.

He also noted

that there were some ship building and ship acquisition funds all over the

world that Nigerian ship owners could benefit from.

that there were some ship building and ship acquisition funds all over the

world that Nigerian ship owners could benefit from.

“These funds

help the European ship builders to sell while they help us acquire the vessels.

We should be able to tap into such opportunities,’’ he said.

help the European ship builders to sell while they help us acquire the vessels.

We should be able to tap into such opportunities,’’ he said.

Ajogwu also

stressed the need to separate assets ownership from operations, saying that

most Nigerian ship owners lacked the managerial skills to handle the management

aspect of the assets.

stressed the need to separate assets ownership from operations, saying that

most Nigerian ship owners lacked the managerial skills to handle the management

aspect of the assets.

“We are in a

world where some of these processes have been tested so we just have to

replicate the initiatives to suit the local environment in the country,’’ he

said.

world where some of these processes have been tested so we just have to

replicate the initiatives to suit the local environment in the country,’’ he

said.

Reiterating

the point, the Managing Director, Pan African Capital, Mr Christopher Oshiafi,

noted that British Airways owned less than 10 per cent of the aeroplanes in its

fleet.

the point, the Managing Director, Pan African Capital, Mr Christopher Oshiafi,

noted that British Airways owned less than 10 per cent of the aeroplanes in its

fleet.

Providing

another alternative for ship funding, he suggested that ship owners could

approach Export Credit Agencies (ECA), the Nigerian Import-Export (NEXIM) Bank

and other Pan African banks.

another alternative for ship funding, he suggested that ship owners could

approach Export Credit Agencies (ECA), the Nigerian Import-Export (NEXIM) Bank

and other Pan African banks.

Oshiafi noted

that availability and reliability of cash flow from the project would convince

the financiers that the ship owners would be able to repay the debts.

that availability and reliability of cash flow from the project would convince

the financiers that the ship owners would be able to repay the debts.

He also urged

NIMASA to provide an assurance to the financing banks to provide the deficits

if the revenue from the investment falls below projected expectations.

NIMASA to provide an assurance to the financing banks to provide the deficits

if the revenue from the investment falls below projected expectations.

According to

him, this will enable the financiers become more willing to sponsor ship

acquisition.

him, this will enable the financiers become more willing to sponsor ship

acquisition.

The

Director-General of NIMASA, Dr Dakuku Peterside, said that the agency had no

role in making shipping products bankable, saying that the agency could only

function as a regulator.

Director-General of NIMASA, Dr Dakuku Peterside, said that the agency had no

role in making shipping products bankable, saying that the agency could only

function as a regulator.

According to

him, we need to look beyond the over 115 million US dollars CVFF money and

there is need to tackle the issue of transparency.

him, we need to look beyond the over 115 million US dollars CVFF money and

there is need to tackle the issue of transparency.

He said that

the Minister of Transportation, Mr Rotimi Amaechi, had called on stakeholders

in August 2018 to deliberate on the disbursement of CVFF.

the Minister of Transportation, Mr Rotimi Amaechi, had called on stakeholders

in August 2018 to deliberate on the disbursement of CVFF.

Speaking from

the point of view of ship owners, the President of the Nigerian Indigenous

Shipowners Association (NISA) Mr Aminu Umar, described the business environment

for ship owners in the country as “extremely challenging.’’

the point of view of ship owners, the President of the Nigerian Indigenous

Shipowners Association (NISA) Mr Aminu Umar, described the business environment

for ship owners in the country as “extremely challenging.’’

He lamented

that beyond the obvious challenges of funding; there was also another tasking

problem of infrastructure.

that beyond the obvious challenges of funding; there was also another tasking

problem of infrastructure.

“The

infrastructure isn’t up to the global best standards and this has posed several

safety issues to ship owners. We have ugly experiences as a result of channels

that aren’t dredged and there are no tugboats to assist the vessels.

infrastructure isn’t up to the global best standards and this has posed several

safety issues to ship owners. We have ugly experiences as a result of channels

that aren’t dredged and there are no tugboats to assist the vessels.

“The channels

aren’t well dredged so vessels encounter accidents and we can’t see the

underwater.

aren’t well dredged so vessels encounter accidents and we can’t see the

underwater.

“We only use

the chart to see the draft of the water. These are infrastructure challenges

and there are no provisions for emergency vessels for incidents offshore

Nigeria.

the chart to see the draft of the water. These are infrastructure challenges

and there are no provisions for emergency vessels for incidents offshore

Nigeria.

These are

infrastructure deficits that the government should address,’’ Umar said.

infrastructure deficits that the government should address,’’ Umar said.

The

Publisher, www.onepageafrica.com, Mrs Hope Orivri, said that a strong single

institution would address the problem facing the disbursement of the Cabotage

Vessel Financing Fund (CVFF).

Publisher, www.onepageafrica.com, Mrs Hope Orivri, said that a strong single

institution would address the problem facing the disbursement of the Cabotage

Vessel Financing Fund (CVFF).

Orivri urged

NIMASA to enlighten ship owners and banks on how they could benefit from the

CVFF funds.

NIMASA to enlighten ship owners and banks on how they could benefit from the

CVFF funds.

The convener

of NISFCOE, Mrs Ezinne Azunna, in her welcome address, said that ships were

assets to any nation for trade and in times of emergency.

of NISFCOE, Mrs Ezinne Azunna, in her welcome address, said that ships were

assets to any nation for trade and in times of emergency.

She stressed

that maritime nations always had to consciously pay attention to funding of the

heavy infrastructure available in the maritime sector because of the capacity

of the sector to keep the entire nation afloat.

that maritime nations always had to consciously pay attention to funding of the

heavy infrastructure available in the maritime sector because of the capacity

of the sector to keep the entire nation afloat.

Azunna

expressed optimism that the maritime sector in Nigeria had the capacity to

contribute significantly to the nation’s GDP.

expressed optimism that the maritime sector in Nigeria had the capacity to

contribute significantly to the nation’s GDP.

“The benefits

of developing the sector no doubt outweigh the cost and sacrifices we have to

make.

of developing the sector no doubt outweigh the cost and sacrifices we have to

make.

“This is why

this year’s theme “Advancing Ship & Maritime Infrastructure Financing

in Nigeria: Innovative Concepts & Sustainable Approaches’’ is more

appropriate,’’ she said.

this year’s theme “Advancing Ship & Maritime Infrastructure Financing

in Nigeria: Innovative Concepts & Sustainable Approaches’’ is more

appropriate,’’ she said.

Azunna

suggested that there should be funding ideas, opportunities and insights which the

sector could leverage on. (NAN)

suggested that there should be funding ideas, opportunities and insights which the

sector could leverage on. (NAN)