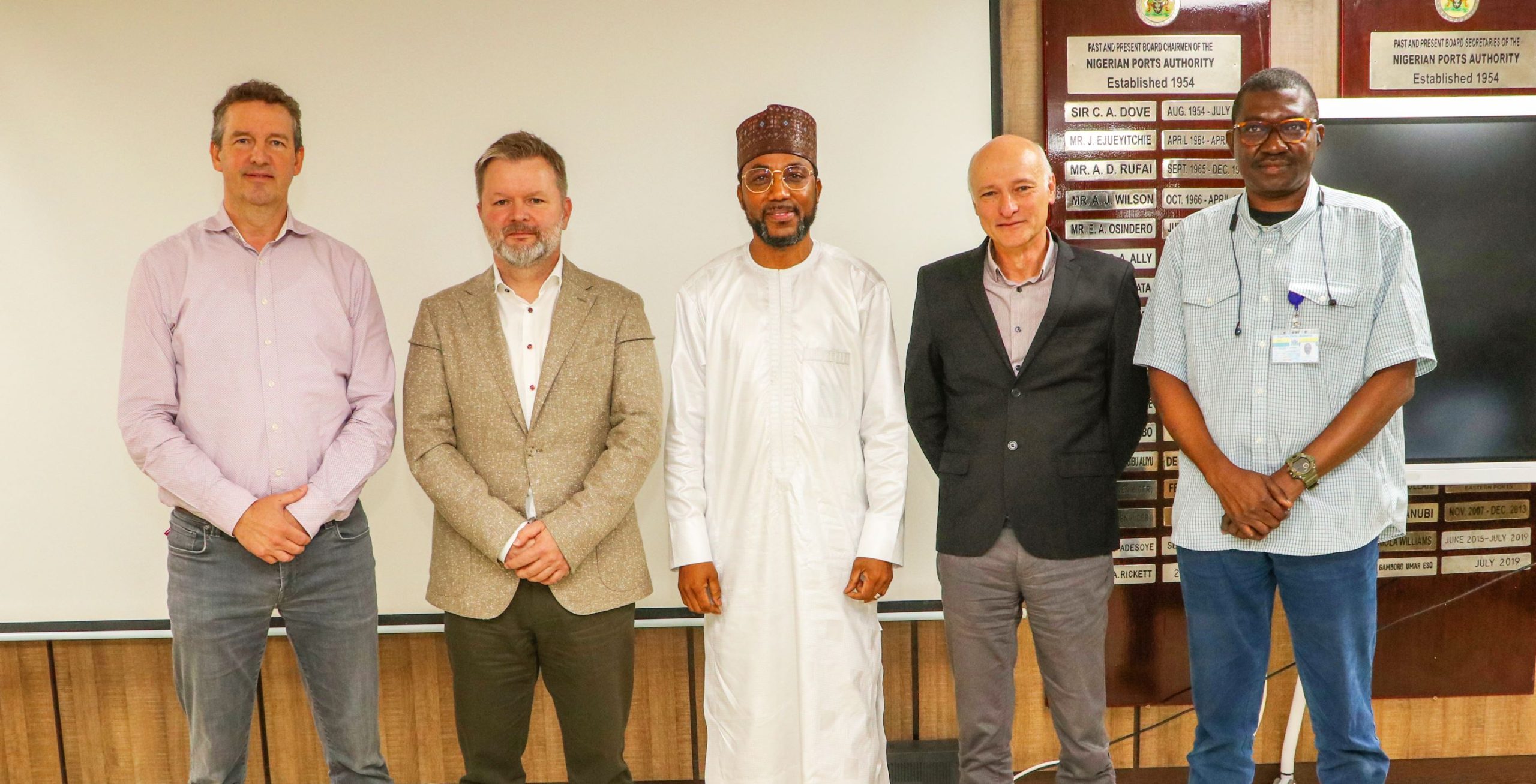

Lagos Deep Offshore Logistic Base, LADOL, has been selected by the London

Stock Exchange (LSE) as one of its companies to inspire in Africa in 2019.

Stock Exchange (LSE) as one of its companies to inspire in Africa in 2019.

The report by the LSE was launched on Wednesday at the opening of

the market in London at the LSE.

the market in London at the LSE.

This is the second edition of the prestigious report

which identifies Africa’s most inspirational and dynamic private, high-growth

companies. The report aims to give these companies global recognition and

attract foreign investment into the continent.

which identifies Africa’s most inspirational and dynamic private, high-growth

companies. The report aims to give these companies global recognition and

attract foreign investment into the continent.

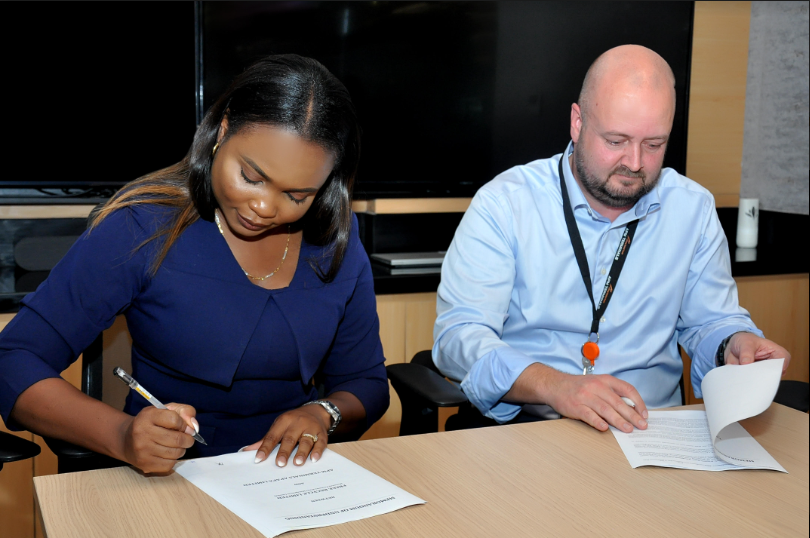

Managing Director of LADOL, Dr. Amy Jadesimi, said:

“LADOL is honoured to be included in London Stock Exchange’s (LSE) list of

Companies to Inspire Africa. We thank the entire LSE team for all their hard

work in complying the report and today’s launch, at which I was proud to be

invited to speak.

“LADOL is honoured to be included in London Stock Exchange’s (LSE) list of

Companies to Inspire Africa. We thank the entire LSE team for all their hard

work in complying the report and today’s launch, at which I was proud to be

invited to speak.

“LSE’s high-profile focus on real indigenous private

sector companies across the African continent is an important step in

highlighting the fact that Africa is already home to a thriving and growing

number of leading companies.

sector companies across the African continent is an important step in

highlighting the fact that Africa is already home to a thriving and growing

number of leading companies.

“The broad range of companies represented show how shallow investment

understanding of our currently markets is and how many opportunities there are

for investment today. We look forward to working with the LSE and cooperating

with the other indigenous companies highlighted.”

understanding of our currently markets is and how many opportunities there are

for investment today. We look forward to working with the LSE and cooperating

with the other indigenous companies highlighted.”

She explained that investment in Africa is about the

market case, noting that instead of eking out low returns from investments in

developed markets, international investors should focus on the many hugely

lucrative market opportunities across Africa.

market case, noting that instead of eking out low returns from investments in

developed markets, international investors should focus on the many hugely

lucrative market opportunities across Africa.

“Investing in Africa requires a seismic change in

investment strategy – international investors that want to remain relevant and

viable need to immediately invest in new diverse teams and new financial

instruments that will enable them to invest in Africa. Teams that use outdated

and inappropriate bankability definitions will continue to struggle to tap into

this highly lucrative market.”

investment strategy – international investors that want to remain relevant and

viable need to immediately invest in new diverse teams and new financial

instruments that will enable them to invest in Africa. Teams that use outdated

and inappropriate bankability definitions will continue to struggle to tap into

this highly lucrative market.”

“Operating out of LADOL saves IOCs 50% on their costs

in deep offshore logistics, saving billions of USD each year. This compelling

value proposition was well known for over decade and a half, yet today LADOL is

the only deep offshore support base in Lagos. A clear example of how

international investors are missing out on billion dollar investment

opportunities by not investing in market case-based business models in Africa,”

Dr. Amy said.

in deep offshore logistics, saving billions of USD each year. This compelling

value proposition was well known for over decade and a half, yet today LADOL is

the only deep offshore support base in Lagos. A clear example of how

international investors are missing out on billion dollar investment

opportunities by not investing in market case-based business models in Africa,”

Dr. Amy said.

Commenting on 2019 report, LSE CEO, David Schwimmer said: “London Stock

Exchange Group’s ‘Companies to Inspire Africa’ report showcases inspirational

and entrepreneurial businesses from across the African continent, representing

a wide variety of industries and countries. It is particularly encouraging to

see the increasing influence of women in leadership roles in these fast-growing

companies, playing a pivotal role in shaping the future of African business.

“These high growth companies have the potential to

transform the African economy and become tomorrow’s job creators. At LSEG, we

are committed to helping companies realise that potential and we are pleased to

highlight and celebrate the company success stories behind one of the world’s

fastest growing markets.”

transform the African economy and become tomorrow’s job creators. At LSEG, we

are committed to helping companies realise that potential and we are pleased to

highlight and celebrate the company success stories behind one of the world’s

fastest growing markets.”

Uyi Akpata, West Africa Regional Senior Partner, PwC,

said: “Initiatives such as this help expose these companies to a global

audience, and we hope will lead to further collaboration across border with

London-based investors and strategic partners. It is also great to see the

public sector represented here. It is an important testament to their

commitment to supporting the private sector and continuing to drive

improvements in ease of doing business.”

said: “Initiatives such as this help expose these companies to a global

audience, and we hope will lead to further collaboration across border with

London-based investors and strategic partners. It is also great to see the

public sector represented here. It is an important testament to their

commitment to supporting the private sector and continuing to drive

improvements in ease of doing business.”