The Nigerian Maritime Administration and Safety Agency (NIMASA) says it wants a better interest rate from the concerned banks for the proposed disbursement of the Cabotage Vessel Financing Fund (CVFF) to indigenous shipowners.

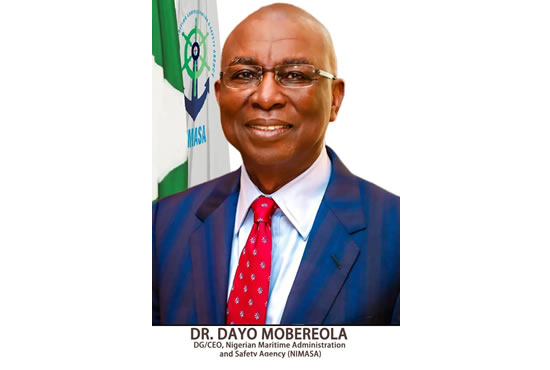

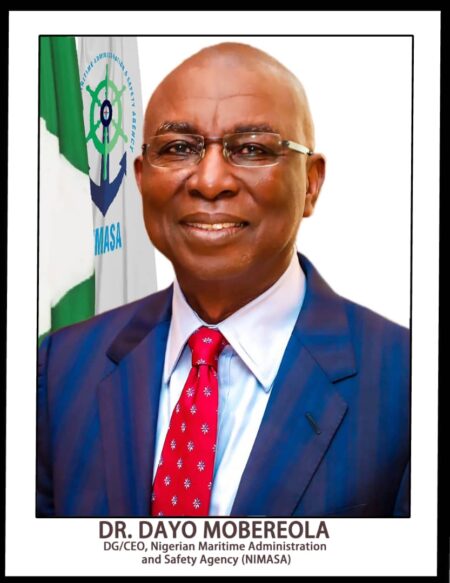

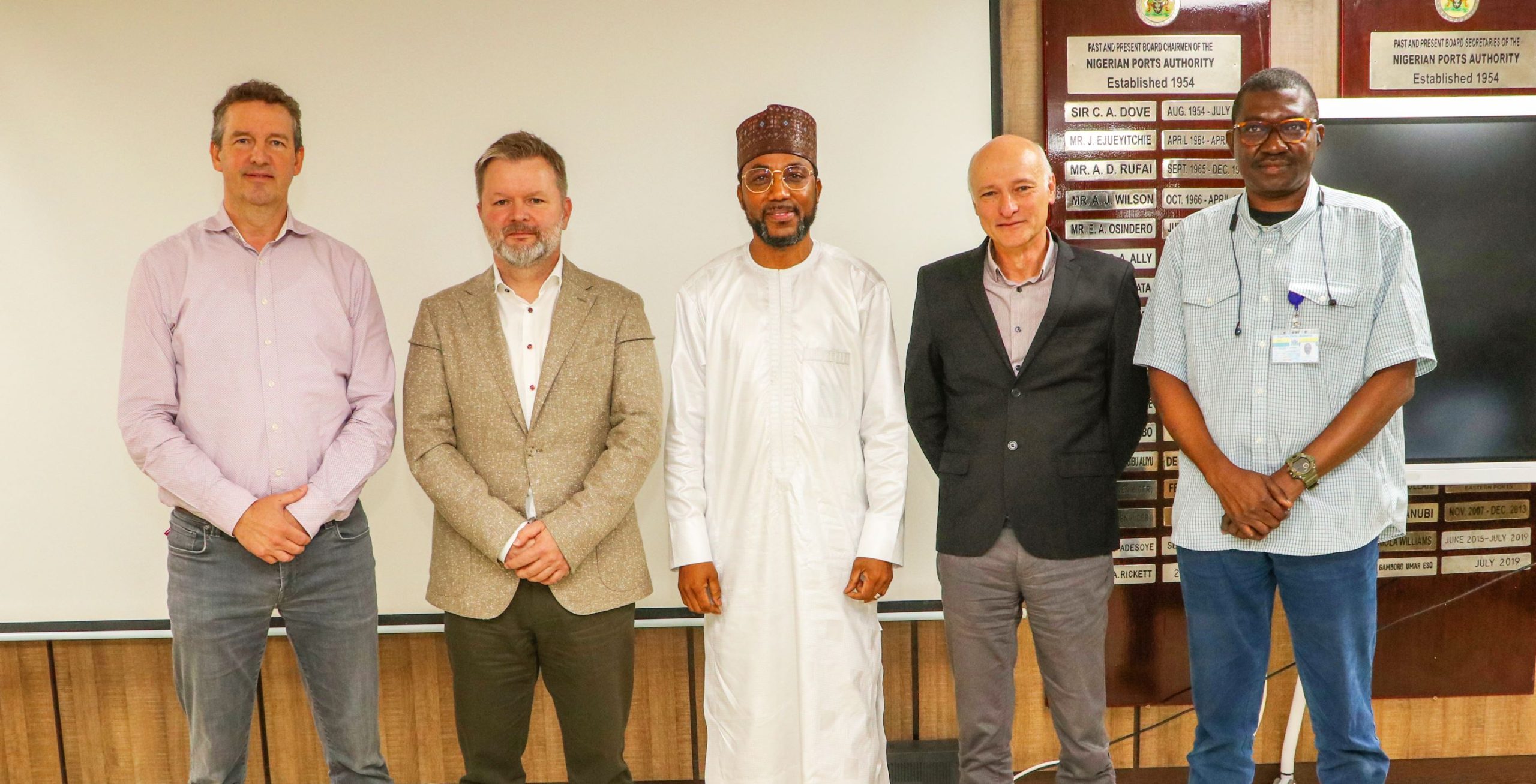

Director General of NIMASA, Dr. Bashir Jamoh, disclosed this on Tuesday after a formal meeting welcoming visiting members of the Ghana Maritime Authority (GMA) who are in Nigeria to understudy Nigeria’s Cabotage regime.

Jamoh who was responding to questions on why the funds were yet disbursed as been promised, said: “We are still discussing back and forth with the PLIs and unless we are sure we are getting the best deal that can help the stakeholders, we will never accept any Primary Lending Institution impose unnecessary guidelines or interest rates. These are the core issues that we are dealing with. If we complete the issue of those grey areas then we will definitely disburse the fund before the end of the regime and if we didn’t finish, when the new regime comes we will continue and they will advise us on the way forward. But we don’t want to put any liability on the stakeholders or government.

“We must get the best bargain for the stakeholders. We can’t accept any interest rate that will remain a burden for the stakeholders. The 15 per cent of the fund is coming from the stakeholders (Shipowners), 50 per cent is coming from the government. So, if PLIs are to provide only 35 per cent, they can’t come and impose high interest rate on the stakeholders. This is one of the major grey areas why we are going back and forth.”

According to the NIMASA DG, they were already seeking alternatives with other banks such as the development banks.

“We are making contacts from other development banks to see how much they can give. We will now put it on the table. Even though the PLIs from our guidelines signify they are commercial banks, but development banks, are banks that can provide funding .We are consulting other banks, so we can do peer review.

“Last week, we reached certain milestones and we had discussions with some of the stakeholders and the stakeholders still feel that the interest rate is still high so we are going back to the drawing table to make sure that the interest rate we are accepting is the one that will favour all the stakeholders.

“So, the interest rate is what is stalling disbursement. The last time it was 8.5 per cent, but we still want it to go down; we want single digit and we are asking them to go down again,” he said.

For the records, the five banks approved as PLIs for the project include Jaiz Bank, United Bank of Africa (UBA), Union Bank, Zenith Bank and Polaris Bank. And by the CVFF guidelines, are to provide 35 per cent equity contribution while shipowners will provide 15 per cent, and 50 per cent by the government through NIMASA.

Jamoh gave assurances that the amended Cabortage act would be assented before the end of President Buhari’s administration, and made clear that the amendment would not affect the disbursement of the fund.

“The amendment of the Cabotage act has nothing to do with the disbursement. They are all different phenomenal. The issue of the amendment for us…We have been implementing the Act for the past 20 years, and a lot of things came to limelight. In the course of implementing policies you find a lot of bottlenecks where you have to get something done so that you have easy process of implementation. So that is the amendment. The core basis of the Cabotage Act still remains where it is. So, the amendment is entirely different issue from the disbursement. I am nit in position to say if the disbursement will take place before the end of this regime or not,” he said.

Welcoming the Ghana Maritime Authority (GMA) delegation that has come to understudy Nigeria’s Cabotage regime, Jamoh said the meeting has established a platform for NIMASA and the GMA, for continued engagement to strengthen the approach towards building indigenous capacity for both countries’ maritime sectors.

He highlighted the need and importance for both countries to share ideas on how to achieve their core mandates and ensuring global best practices in the affairs of the Gulf of Guinea maritime sector.

Earlier, head of the delegation and the Director, Legal/ Board Secretary of Ghana Maritime Authority (GMA), Mrs. Patience Diaba, said that the team was in Nigeria to understudy the implementation of the Cabotage Act.

She said lessons learned would help Ghana in the effective implementation of its Cabotage regime and avoid challenges that affected Nigeria in the implementation of its Cabotage regime.

“We are here because we are about to implement our own Cabotage regulations. It is better to learn first-hand this challenges Nigeria went through, so that we don’t need to go through the same, coming here the first thing to learn is the challenges and how we won’t fall into the dangers.

“If we start like that, we will go faster than Nigeria because Nigeria has to do a lot of learning along the line but we are fortunate that we will hear from them what went wrong and how to get out of it and mechanisms put in place when we do that.

“We are confident that our time will be rewarding and we will return to Ghana better informed and equipped to implement the Cabotage regime in our nation,” she said.

The CVFF is a special Fund that is basically obtained through the collection of a 2% surcharge from the total contract sum performed by any vessel engaged in Cabotage trade. The fund aims to offer financial assistance, create access to funding by financial institutions with a focus to increasing indigenous ship acquisition capacity for qualified Nigerians.