Despite several financing options for ship acquisition in Nigeria, indigenous ship owners have yet been able to fully access any in the quest for shipping development.

The situation makes it a herculean task for indigenous shipowners to compete with international shipping operators who have access to cheap financing.

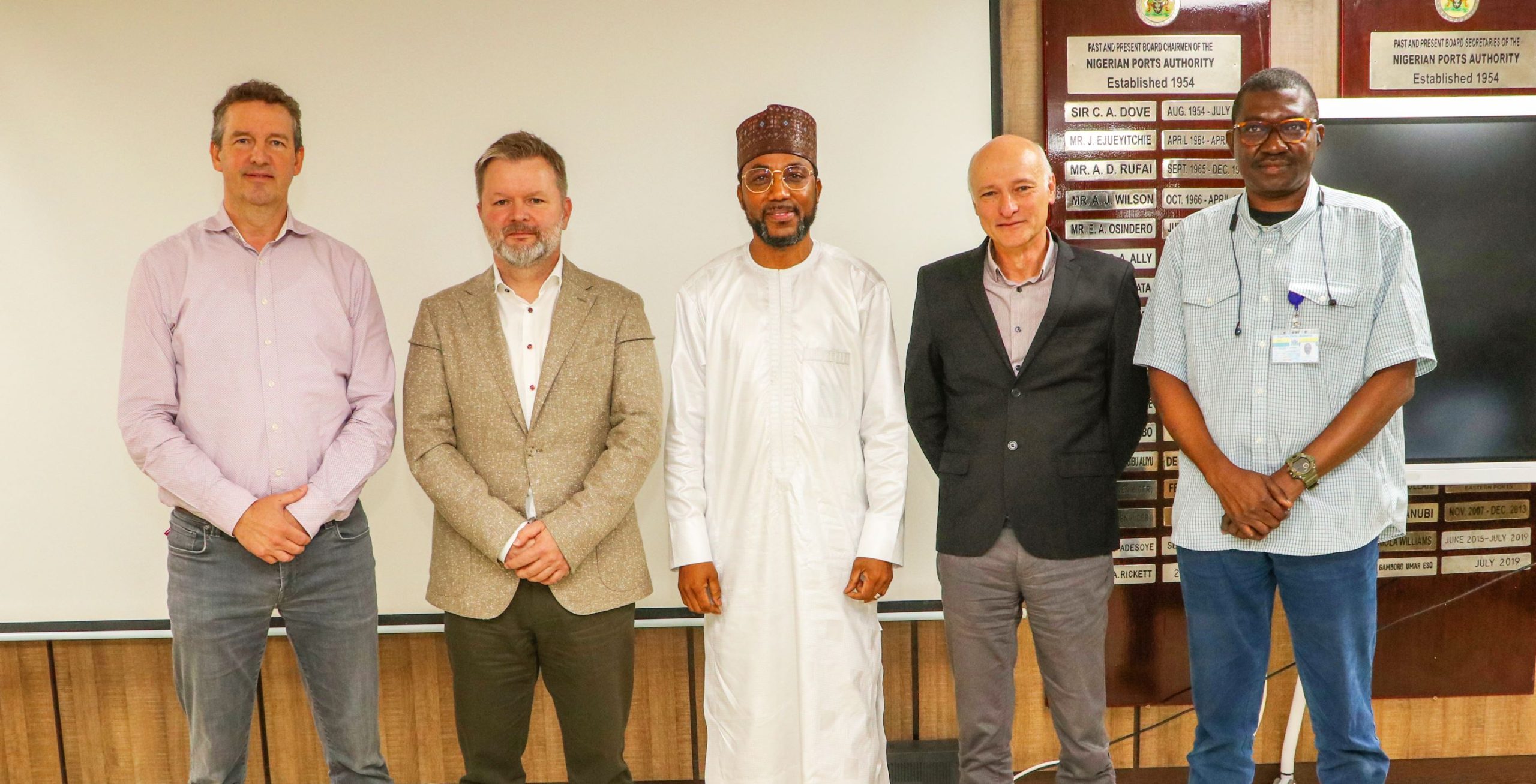

These issues were part of the discussions highlighted at the second quarterly lecture held by the Nigerian Association of Master Mariners (NAMM) weekend in Lagos.

Although Captain Emmanuel Iheanacho, the Chairman Genesis Worldwide Shipping Ltd., noted in the lecture titled ‘Cabotage Financing’ that government’s efforts through several ship financing schemes aims at increasing indigenous ship ownership and enhance their competitiveness in the global market trade, concerns are still being raised as to why the continued difficulty in accessing them.

For example, the master mariners agreed that the Cabortage vessel financing fund ( CVFF) which is accrued from the 2 per cent surcharge on carriage contracts performed by vessels engaged in domestic or inland shipping in Nigeria, should have been disbursed to support acquisition of ships by the indigenous shipowners.

Other ship financing initiatives by the Nigerian government have included the Ship Acquisition and Ship Building Fund (SASBF) for direct funding for ship acquisition and building, the cargo reservation policy ; reserving a portion of Nigeria’s cargo for transportation by indigenous shipping companies, the Asset Acquisition and Project Finance initiated by the Nigerian Content Development and Monitoring Board(NCDMB) as well as its Marine Vessel Categorisation strategy to finance vessel acquisition.

Since the government’s initiatives have not been able to address the needs area, indigenous shipowners will have to deal with double-digit interest rates on ship financing where short term loans in Nigeria (less than two years) attract from 15% to 25% yearly, long term loans (5 to 10 years) attract 10% to 18%. For Lease financing the interest rate is between 8% to 15% and asset-based financing goes for 10% – 18% yearly.

According to Iheanacho in his lecture, the above development is found among the various commercial banks in Nigeria that provides some form of ship acquisition financing. They include; Zenith Bank, Guarantee Trust Bank, United Bank for Africa, First Bank, and Access Bank.

He added that “The challenges of ship financing are high interest rates, short loan tenures, risk perception by banks, inadequate maritime infrastructure, corruption and bureaucratic hurdles, foreign exchange fluctuations and limited access to international funding.”

In his contribution, President of the NAMM, Capt. Tajudeen Alao, called for a feasible structure for ship financing to enable indigenous operators participate favourably and be able to create jobs for economic growth nationally.

The NAMM president wants government to give attention to the 3% shipping development fund being collected by the Nigerian Maritime Administration and Safety Agency (NIMASA), but yet to give a corresponding benefit to indigenous shipping business.

Another critical point raised by Capt. Alao is that the banks actually do not have adequate understanding of how international shipping works, this making it difficult for them to manage the shipping loan structure.

His words: “Many people took loans from banks, but the banks could not trace the ships. They don’t know where the ships are. They have risk management, they have schedule officers, but they don’t have a clue as to what to do. They don’t know what international shipping is about.”

For the multitude challenges that have made development in the sub-sector relatively slow, Capt. Alao believes that it has become critical for financing interventions to be available to propel the industry to have many players.

The master mariners agreed that Nigeria should urgently begin to build badges and small crafts while structure should be established with plans for ship-building.