|

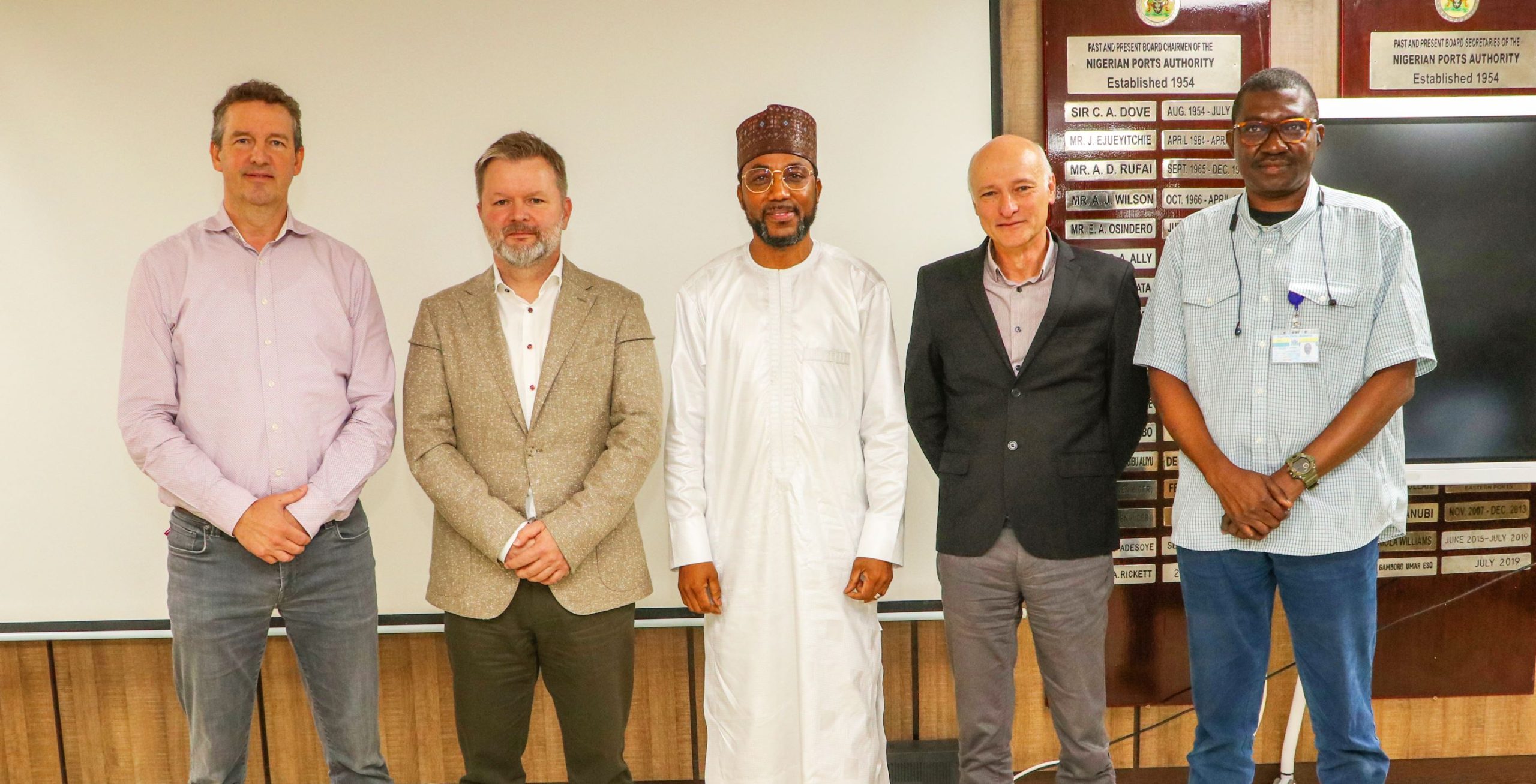

| CBN Governor, Godwin Emefiele |

The Central Bank of

Nigeria (CBN) has authorized the use of Renminbi (RMB) instead of dollar by

Nigerians to import some specific goods from China to achieve maximum benefit

in the recent $2.5 billion currency swap pact signed by both countries.

Nigeria (CBN) has authorized the use of Renminbi (RMB) instead of dollar by

Nigerians to import some specific goods from China to achieve maximum benefit

in the recent $2.5 billion currency swap pact signed by both countries.

This was disclosed at a press briefing organised by

the apex bank at the end of the Bankers Committee meeting held in Lagos

yesterday.

the apex bank at the end of the Bankers Committee meeting held in Lagos

yesterday.

According the committee, importers of Chinese

equipment, machineries and goods are expected to obtain invoices in RMB instead

of dollar for settlement which would ultimately cut down transaction cost and

make importation cheaper for Nigerians playing in that market segment.

equipment, machineries and goods are expected to obtain invoices in RMB instead

of dollar for settlement which would ultimately cut down transaction cost and

make importation cheaper for Nigerians playing in that market segment.

The committee said

the arrangement would go a long way to strengthen the nation’s external reserve

which is currently put at $48 billion.

the arrangement would go a long way to strengthen the nation’s external reserve

which is currently put at $48 billion.

Specifically, a member of the Bankers’ Committee and

the Chief Executive, Stanbic IBTC Bank, Demola Sogunle, said: “CBN and the

Bankers Committee are to start encouraging importers to receive invoices in

Renminbi instead of dollars.

the Chief Executive, Stanbic IBTC Bank, Demola Sogunle, said: “CBN and the

Bankers Committee are to start encouraging importers to receive invoices in

Renminbi instead of dollars.

One of the incentives will be that a percentage spread

will be given to any importer that is bringing a Renminbi invoice for

settlement instead of bringing a dollar invoice.

will be given to any importer that is bringing a Renminbi invoice for

settlement instead of bringing a dollar invoice.

If you bring Renminbi invoice, the benefit is that it

is going to be cheaper for the importer in coming to CBN to get foreign

currency which, in this case, will be Renminbi.

is going to be cheaper for the importer in coming to CBN to get foreign

currency which, in this case, will be Renminbi.

“The importer will actually bring lesser amount of

naira.

naira.

If he goes ahead to buy with the same supplier based

in China and collect invoice in dollars, it will cost the importer slightly

more in terms of the naira amount he will use to get the foreign currency.

in China and collect invoice in dollars, it will cost the importer slightly

more in terms of the naira amount he will use to get the foreign currency.

“We have got almost $48 billion in external reserve,

because we trade a lot with China.

because we trade a lot with China.

If we are able to continue to bring in machinery and

equipment, without depleting our dollar reserve, the external reserve will not

be under threat.

equipment, without depleting our dollar reserve, the external reserve will not

be under threat.

So with the Renminbi in place instead of dollar, based

on this swap deal, we are in a very good position. So importers are encouraged

to bring in invoices in Renimbi instead of dollars.”

on this swap deal, we are in a very good position. So importers are encouraged

to bring in invoices in Renimbi instead of dollars.”

The Guardian.