|

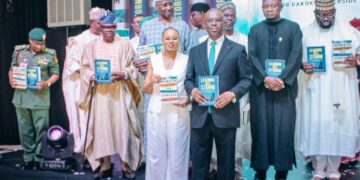

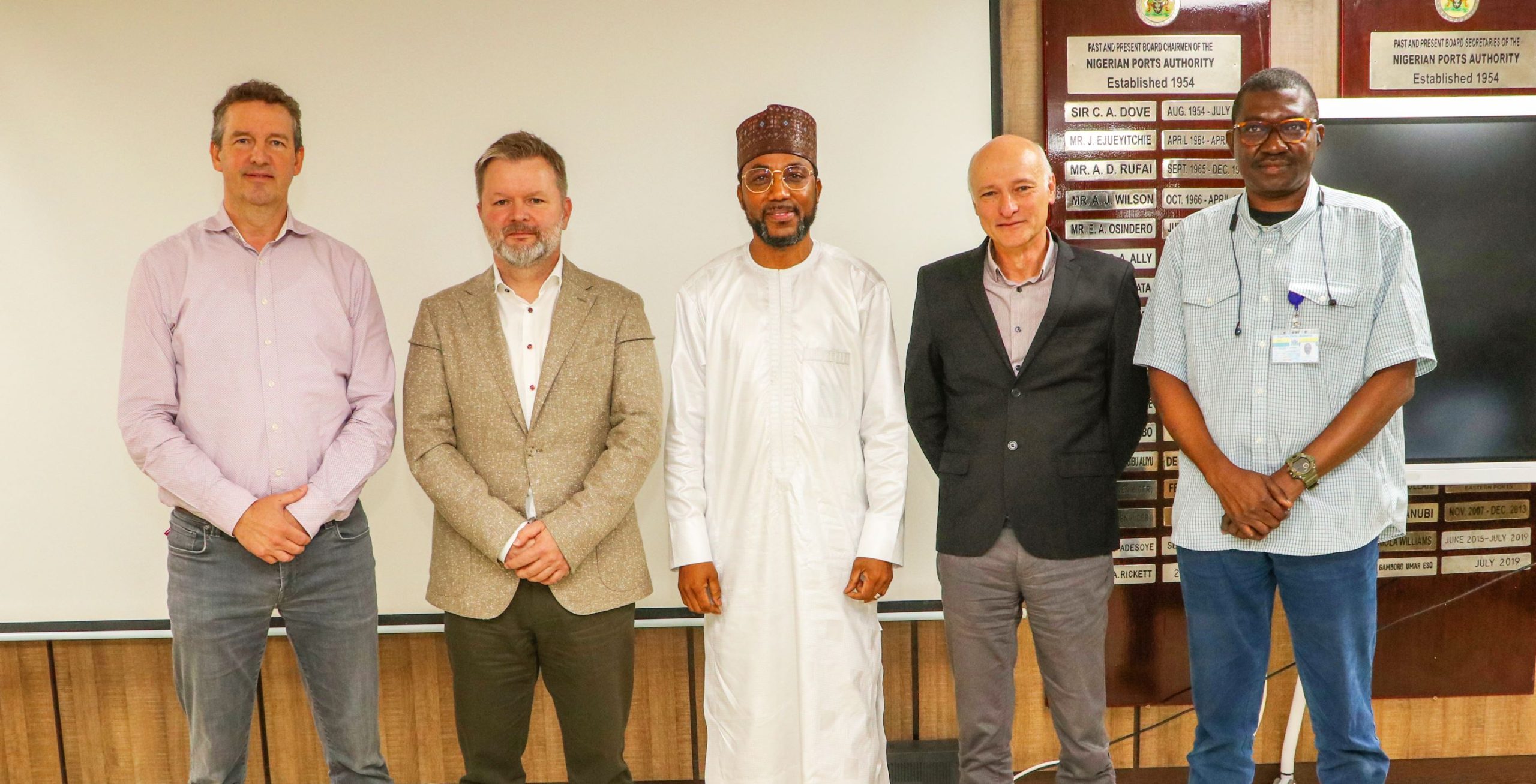

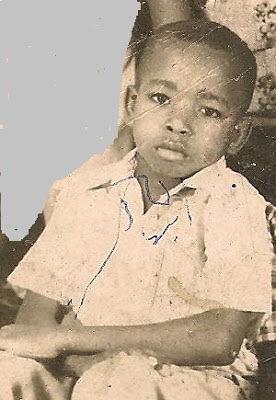

| Dr. Olisa Agbakoba |

Renowned Legal Practitioner and Human

Rights Activist, Dr. Olisa Agbakoba has said that Nigeria’s economy is facing

a recession in the face of dwindling oil revenue, and a challenged manufacturing

sector plagued by funding gaps.

Rights Activist, Dr. Olisa Agbakoba has said that Nigeria’s economy is facing

a recession in the face of dwindling oil revenue, and a challenged manufacturing

sector plagued by funding gaps.

Agbakoba stated this at an

interactive forum convened by the Olisa Agbakoba Legal in Lagos.

He told newsmen that although the

anti-corruption crusade and the Treasury Single Account initiative had saved

over 3 trillion Naira, the benefit must translate into using the milestones to

stimulate the economy.

anti-corruption crusade and the Treasury Single Account initiative had saved

over 3 trillion Naira, the benefit must translate into using the milestones to

stimulate the economy.

As a solution, he advised that the

Central Bank of Nigeria (CBN) played a significant role of ‘’creating money by

buying securities such as government bonds from banks, with electronic cash

that did not exist before.

Central Bank of Nigeria (CBN) played a significant role of ‘’creating money by

buying securities such as government bonds from banks, with electronic cash

that did not exist before.

He said the “new money swells the

size of bank reserves in the economy by the quantity of assets purchased—hence

“Quantitative” Easing.

size of bank reserves in the economy by the quantity of assets purchased—hence

“Quantitative” Easing.

“Like lowering interest rates, QE is

supposed to stimulate the economy by encouraging banks to make more loans.

supposed to stimulate the economy by encouraging banks to make more loans.

“The idea is that banks take the new

money and buy assets to replace the ones they have sold to the CBN.

money and buy assets to replace the ones they have sold to the CBN.

“That raises stock prices and lowers interest

rates, which in turn boosts investment,” Agbakoba said.

rates, which in turn boosts investment,” Agbakoba said.

He

blamed the non-achievement of a diversified economy on dearth of infrastructure

to support economic activities in various sectors.

blamed the non-achievement of a diversified economy on dearth of infrastructure

to support economic activities in various sectors.

He,

however, advised that Nigeria should revisit the option of receivable

financing.

however, advised that Nigeria should revisit the option of receivable

financing.

“The proposal that Nigeria pledges

her oil to receive loan from countries like China, should be revisited.

her oil to receive loan from countries like China, should be revisited.

“We need to fill our huge deficit gap

by receivable financing. It is only such huge receipt of funds that could plug

the serious infrastructural deficit that impede diversification in Nigeria.”

by receivable financing. It is only such huge receipt of funds that could plug

the serious infrastructural deficit that impede diversification in Nigeria.”

According

to him, the ‘’comatose state’ of the

manufacturing sector resulting from high cost of doing business had made job

creation difficult, even as small businesses are staved of capital.

to him, the ‘’comatose state’ of the

manufacturing sector resulting from high cost of doing business had made job

creation difficult, even as small businesses are staved of capital.

“Jobs can only be created when we

have a vibrant manufacturing and real sector.

have a vibrant manufacturing and real sector.

“Currently, the manufacturing sector is

in a comatose state with the Manufacturers Association of Nigeria constantly

complaining of the need to reduce the cost of doing business.

in a comatose state with the Manufacturers Association of Nigeria constantly

complaining of the need to reduce the cost of doing business.

“Small Businesses are hindered

because of absence of capital: they cannot easily access loans from banks.

Interest rates are high and banks are shy to lend because of the problem of bad

debts, exacerbated by inefficient regulatory environment,” Agbakoba said.

because of absence of capital: they cannot easily access loans from banks.

Interest rates are high and banks are shy to lend because of the problem of bad

debts, exacerbated by inefficient regulatory environment,” Agbakoba said.

As a key point, Agbakoba advised on

the importance of getting the Financial Services Sector right, which he said

should include having the CBN focus on lending, interest rate and exchange and

not being overburdened.

the importance of getting the Financial Services Sector right, which he said

should include having the CBN focus on lending, interest rate and exchange and

not being overburdened.

He spoke in favour of deregulation,

advising that market forces be allowed to determine the exchange value, while

the CBN should not restrict the flow of foreign exchange, an act that restricts

critical stakeholder’s participation.

advising that market forces be allowed to determine the exchange value, while

the CBN should not restrict the flow of foreign exchange, an act that restricts

critical stakeholder’s participation.

“The problem with Forex is that CBN

does not have enough, but if we expand the space, we would be surprised that

many Nigerians can participate and increase the stock.

does not have enough, but if we expand the space, we would be surprised that

many Nigerians can participate and increase the stock.

“All that is needed is to create a

legal framework to encourage this participation, subject to Money laundering

Rules.”

legal framework to encourage this participation, subject to Money laundering

Rules.”

Agbakoba bemoaned the conditions of

Nigeria’s State-owned Public Enterprises, saying that the privatization model

had not been successful in Nigeria’s case, compared to a country like China.

Nigeria’s State-owned Public Enterprises, saying that the privatization model

had not been successful in Nigeria’s case, compared to a country like China.

“In fact, none of the privatized

entities in Nigeria could serve as a model. It is urgent therefore, that

Nigeria reviews her Public/Private Economy.

entities in Nigeria could serve as a model. It is urgent therefore, that

Nigeria reviews her Public/Private Economy.

“Government must control the

overarching sectors of the Economy. There is need for a strong Public/Private

Sector Framework.”

overarching sectors of the Economy. There is need for a strong Public/Private

Sector Framework.”

He, however, applauded Nigeria’s

rating as the 20th largest economy in the world, noting that

reviewing the nation’s public/private economy would go a long a way to turning potentials

into reality and moving the economy forward.

rating as the 20th largest economy in the world, noting that

reviewing the nation’s public/private economy would go a long a way to turning potentials

into reality and moving the economy forward.