|

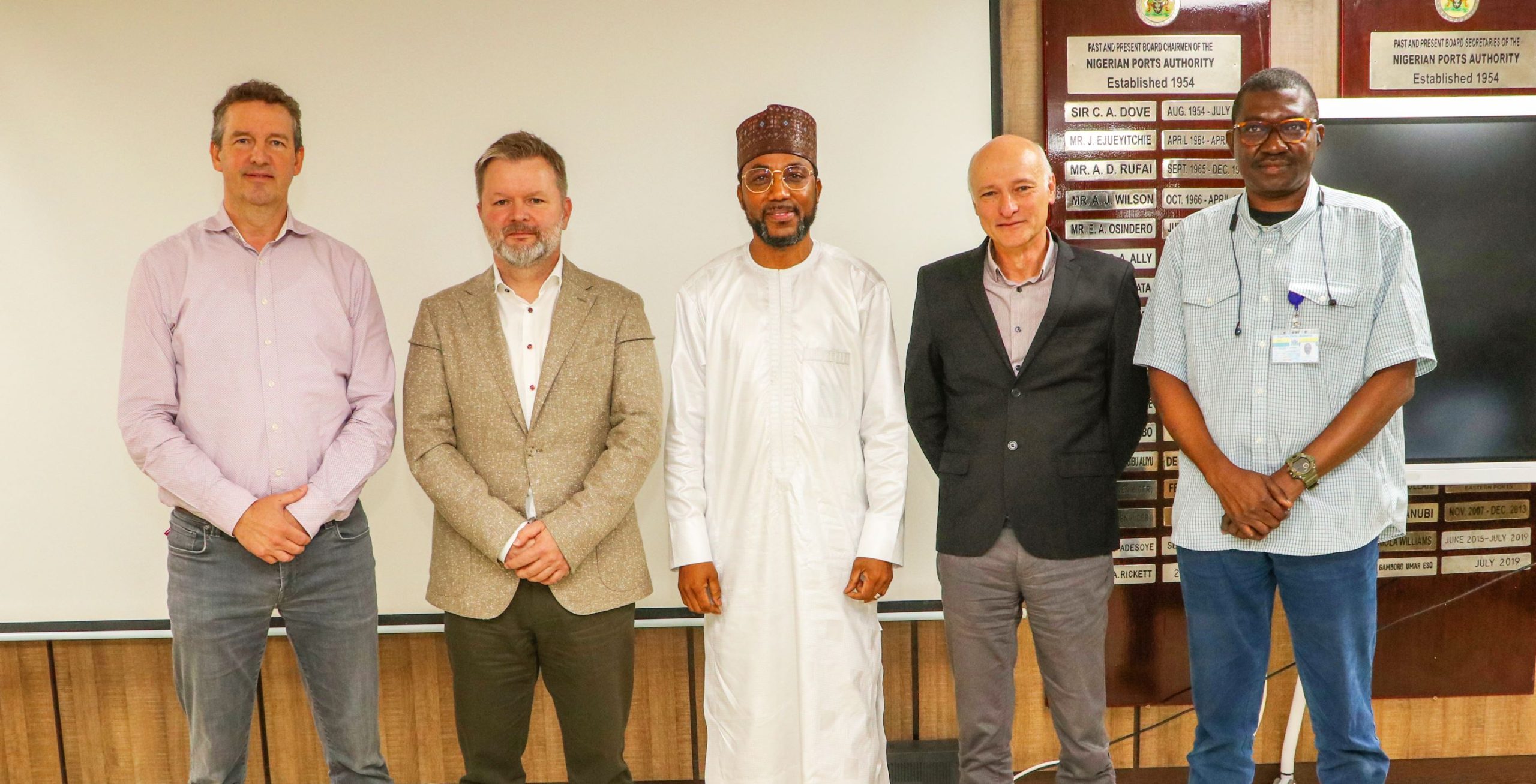

| CAC Eporwei Edike |

A

performance appraisal of the Pre-Arrival Assessment Report (PAAR) by the

Nigeria Customs Service (NCS) shows that the scheme has delivered value since

it took off on Dec. 1, 2013.

performance appraisal of the Pre-Arrival Assessment Report (PAAR) by the

Nigeria Customs Service (NCS) shows that the scheme has delivered value since

it took off on Dec. 1, 2013.

With a

record 23.4 per cent increase in revenue from N769 billion in 2013, to N950

billion as at November 2014, the NCS says in spite of the initial teething

challenges PAAR has performed well in facilitating trade by ensuring efficiency

in clearance procedures.

record 23.4 per cent increase in revenue from N769 billion in 2013, to N950

billion as at November 2014, the NCS says in spite of the initial teething

challenges PAAR has performed well in facilitating trade by ensuring efficiency

in clearance procedures.

Comptroller

Eporwei Edike, the Controller in charge of the Apapa Area 1 Command of the NCS,

disclosed this while speaking recently at the inauguration of the new

executives of the Maritime Reporters Association of Nigeria (MARAN) in Lagos.

Eporwei Edike, the Controller in charge of the Apapa Area 1 Command of the NCS,

disclosed this while speaking recently at the inauguration of the new

executives of the Maritime Reporters Association of Nigeria (MARAN) in Lagos.

According

to Edike, a total of 201,320 requests for PAAR were received, out of which 14,

259 were rejected while 188, 424 were finally registered.

to Edike, a total of 201,320 requests for PAAR were received, out of which 14,

259 were rejected while 188, 424 were finally registered.

He

disclosed that 108, 159 PAAR were uplifted, with a total Cost Insurance Freight

(CIF) value of N5.6 trillion.

disclosed that 108, 159 PAAR were uplifted, with a total Cost Insurance Freight

(CIF) value of N5.6 trillion.

According

to Edike, the PAAR is to remove the bottlenecks and clogs in the wheels of

trade progress, reduce the time of doing business in Nigerian ports and

increase revenue for government.

to Edike, the PAAR is to remove the bottlenecks and clogs in the wheels of

trade progress, reduce the time of doing business in Nigerian ports and

increase revenue for government.

He

identified issues bordering on compliance and

occasional failure in technology as some of the challenges facing the PAAR),

but added that the newly-installed network mast had taken care of the network

failures to a great extent.

identified issues bordering on compliance and

occasional failure in technology as some of the challenges facing the PAAR),

but added that the newly-installed network mast had taken care of the network

failures to a great extent.

“PAAR has had its fair share of

teething problems, but its greatest challenge is with compliance since that of

technology has been taken care of with the new mast for internet service

provision.

teething problems, but its greatest challenge is with compliance since that of

technology has been taken care of with the new mast for internet service

provision.

“There will be no query with PAAR when

you are transparent because the system is robust. But we will query you when

there are inconsistencies between your declaration and what we see,” Edike

said.

you are transparent because the system is robust. But we will query you when

there are inconsistencies between your declaration and what we see,” Edike

said.

He said the credibility of the PAAR

system further received recognition by the World Customs Organisation(WCO)which

also

encouraged other countries to emulate Nigeria in that regard.

system further received recognition by the World Customs Organisation(WCO)which

also

encouraged other countries to emulate Nigeria in that regard.

The

Comptroller also said that the service had been able to save N36.9billion for

the government through collections of the Comprehensive Import Supervision

Scheme (CISS) levy, which was erstwhile being collected by the service

providers.

Comptroller also said that the service had been able to save N36.9billion for

the government through collections of the Comprehensive Import Supervision

Scheme (CISS) levy, which was erstwhile being collected by the service

providers.